Senior Real Estate Planner

Simplifying Senior Moves with Care, Strategy & Ease

Guiding Your Next Chapter with Care and Confidence

Real estate is more than a transaction. It’s about creating a life you love today while preparing for tomorrow. Whether you’re thinking about downsizing, planning for retirement, selling the family home, or making sure your legacy is secure, you deserve a partner who listens, understands, and helps you every step of the way.

As your Senior Real Estate Planner, I’m here to make the process simple, supportive, and stress-free. Together, we create a plan that fits your goals, supports your lifestyle, and protects your future.

Here’s How I Help You

1. Downsizing Made Easy

We explore options that fit your lifestyle, whether it’s a one-story home, a 55+ community, or assisted living. I’ll walk with you at your pace so you feel confident in your next move.

2. Estate & Legacy Planning Support

I connect you with trusted professionals to make sure your real estate assets are passed on smoothly, minimizing stress and protecting what you’ve built for your loved ones.

3. Maximizing Your Home’s Value

My proven marketing plan ensures your home shines and sells for top dollar, giving you the financial freedom to enjoy the next season of life.

4. Stress-Free Transitions

From organizing and decluttering to estate sales and relocation services, I bring in the right resources to make moving easier.

5. Community Connections You Can Trust

Need financial, legal, or lifestyle support? I have a network of trusted professionals ready to help you with whatever you need.

This is about more than buying or selling a home. It’s about making thoughtful choices for your life and your legacy. I’m here to guide you, cheer for you, and make sure you feel supported every step of the way.

Service You Can Trust

• Trusted Advisor

• Consultation and Planning

• Management of Personal Belongings

• Home Safety and Maintenance Support

• Guidance on Living Options

• Financial and Legal Referrals

• Home Referral Resources

• Estate Sale Coordination

• Home Staging Services

• Move Management Support

• Post-Move Assistance

• Home Market Analysis

• Property Listing and Marketing

• Streamlined Processes for Ease and Comfort

• Strategies to Maximize Your Home’s Value

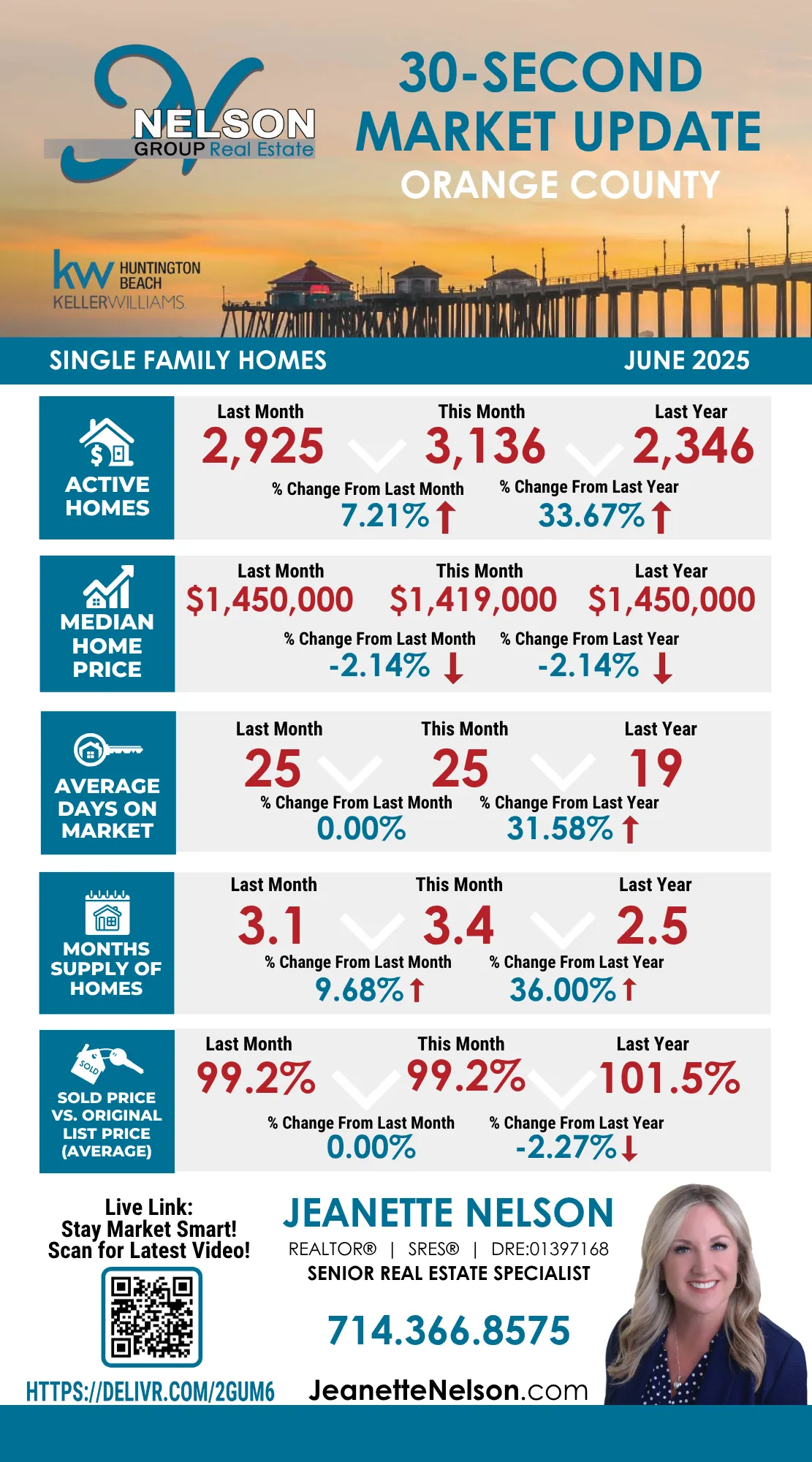

Start Building Your Real Estate Wealth Plan Today

No matter where you are in your real estate journey, a forward-thinking plan can help you

build, protect, and transfer wealth—all tailored to your family’s unique needs and long-term vision.

💬 Are you ready to build a lasting real estate legacy?

Senior Resources

A curated collection of helpful articles designed for seniors who are planning to sell their homes. From step-by-step guides to insider tips, these resources provide practical advice to make the process easier, faster, and more rewarding.

If you’re thinking about downsizing, you may be hearing about 55+ communities and wondering if they’d be a good fit for you.

One of your goals could be selling your house and finding a home that more closely fits your needs.

After years of hard work, it’s finally time to slow down, explore new passions, and live life on your own terms.

If retirement is on the horizon, you want to make sure you’re set up to feel comfortable financially to live the life you want.

The phrase "Silver Tsunami" refers to the idea that a lot of baby boomers are going to move or downsize all at once.

Many of today’s workers who are nearing the end of their professional careers have a new choice to make: should I move before I retire?

Baby boomers are now reaching the age when moving to an active adult community is the ideal opportunity for them.

Before you spend the money to renovate your current house so you can age in place, let’s determine if it is truly your best option.

Homeowners and their families are discovering new ways to get the most out of home with choices that fit the many facets of their lives.

If you have a home that could accommodate a multigenerational family and are thinking about selling, now is the time to put it on the market!

The transition from a current home to a new one is significant to undertake, especially for anyone who has lived in the same house for many years.

One of the reasons for the inventory shortage of homes for sale is that older generations have chosen to “age in place” over moving.

Seller Resource Center

Discover how to sell your home Faster and To get top dollar!

Enjoy the latest & most up-to-date marketing & sales tactics to sell your home fast, for top dollar.

Timelines When Selling a Home

Understand why timing is crucial when selling your home. Learn how the right timing can impact your sale's success.

How Quickly Will My Home Sell

Explore key factors that influence the speed of your home sale. Get insights on how to sell your home faster.

Receiving Offers On Your home

Learn how to effectively manage and evaluate offers on your home. Get tips on making the right decision for a successful sale.

Should I Get An Inspection?

Discover the importance of home inspections before buying or selling. Ensure your investment is safe with a thorough property evaluation.

Curb Appeal Magic

Boost your home's exterior appeal with simple yet effective tips. Learn how to increase value and attract more buyers.

Disruptive Digital Marketing

Attract and engage clients online by implementing innovative and non-traditional marketing strategies.

Want a free Home Value Report?

Click on the button below to request a free home value report for your specific home.

reviews

Read About Why Clients Love

Working With Jeanette

(Hover over video and click CC to see words on video)

"Hiring Jeanette Nelson was the best decision for us. Her legal expertise, contractor connections, decorating sense, and online marketing skills were invaluable." - Doug & Rene

"Find a professional to help you through each and every step. - Gabe

"Jeanette helped my brothers and me sell an inherited house. She assisted our ill mother in selling her home in record time, securing top dollar for the property and closing escrow in just 10 days! Her professionalism, compassion, and tireless efforts saved us from what could have been an estate nightmare. Jeanette's dedication and attention to detail were truly over the top, and we couldn’t be more grateful. We highly recommend her to anyone looking for a knowledgeable, reliable, and caring realtor. Thank you, Jeanette, for everything! - Paula F.

She was outstanding at working with us to establish a reasonable price and provided excellent advice throughout the process. Jeanette introduced us to a good escrow company that was really on top of things. I can’t say enough good things about her for her effort, care and ultimately a very smooth and fast escrow to close the sale!"

- Rick R.

2025 © Nelson Group Real Estate | Keller Williams Realty Huntington Beach

Each office is independently owned and operated.

CA DRE# 01397168